shares in this article

by Julia Gro, Euro on Sunday

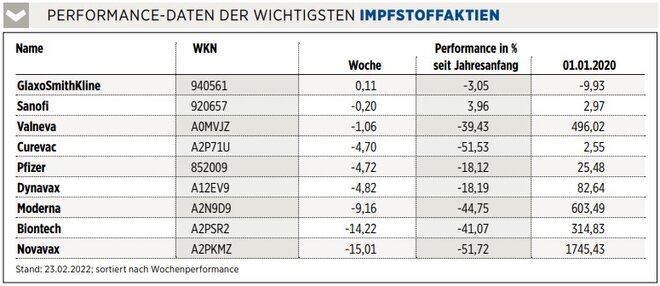

Sanofi and GlaxoSmithkline have presented the final data on their protein-based vaccine and announced that they will apply for approval in the US and Europe. There are extensive studies that have evaluated the vaccine both as a two-dose plus booster priming and as a booster after mRNA or vector priming. The results obtained in an environment with circulating delta and omicron variants are good, in particular the vaccine also seems to prove itself as a booster vaccination for the competing products from BioNTech/Pfizer, Moderna, Astrazeneca and Johnson & Johnson.

Even if the two pharmaceutical giants initially only want to fulfill the existing orders for their Covid vaccine, it is strong competition for the mRNA manufacturers in the medium term. Because a highly effective booster vaccination that can be stored in the refrigerator – most likely already filled into ready-to-use syringes – is much easier for general practitioners to handle than mRNA. And this target group will be important in the future when there are no more vaccination centers.

The shares of the other manufacturers remained under pressure after increasing reports and studies pointing to the fact that vaccination protection lasts for several years and that a vaccine adapted to the omicron variant may not bring any additional benefit. Curevac benefited from the announcement that major shareholder Dietmar Hopp and his family office do not want to sell any more shares on the market, as announced in January.

INVESTOR INFO

The Novavax vaccine was supposed to be delivered to Germany earlier in the week, but there were delays again. According to the editorial network Germany, the material is now expected by Friday. The Bavarian Ministry of Health is now talking about availability only “at the beginning of March”. The fact that there are obviously still problems with the logistics does not go down well on the stock exchange. Novavax will present figures next Monday. One can look forward to the prognosis and statements from the management on how to solve the problems and the further plans. Hard-nosed investors rely on a positive surprise.

The pharmaceutical and biotech market follows its own laws and requires investors to have some medical background knowledge. The management team of the investment company BB Biotech has the necessary knowledge and has repeatedly demonstrated in the past that it can use it successfully. The Swiss got involved with Moderna very early on, where they see potential far beyond the Covid vaccine. The stock accounts for ten percent of the portfolio. Other heavyweights include stocks from Argenx, Ionis, Neurocrine and Vertex Pharmaceuticals. Additionally attractive: there is a high payout.

__________________________________________

Leverage must be between 2 and 20

No data

More news about arGEN-X NV

Image sources: Dan Race / Shutterstock.com, Finanz Verlag

ttn-28