by Sven Parplies, Euro on Sunday

EIn a crash for the history books: More than 27 percent broke the shares of the Internet giant Meta Platforms after the presentation of weak business figures. On just one Tag thus fizzled out more than 250 billion dollars market value. That’s about as if the DAX heavyweights Siemens and Allianz were completely in the airt resolved.

The stock market’s extreme reaction shows how tense the mood is. After the Corona crash, the stock markets went up for two years without any major setbacks. The price gains were particularly impressive for companies in the technology sector: from March 2020 to November 2021, the American stock index Nasdaq 100, which is geared towards growth stocks, rose by 137 percent at its peak. Since then, however, prices have been on the decline. The index fell more than 15 percent. A quarter of the members even has more than a quarter of market value lost.

The trigger for the turbulence is the upcoming turnaround in interest rates. The US Federal Reserve is likely to raise the key rate at least four times this year, probably for the first time in March. Given the unexpectedly persistent inflation, some economists are expecting an even sharper turnaround. This is the end of the era of ultra-cheap money, from which those companies in the stock market in particular benefited, where Wall Street is counting on large increases in profits in the future, but which are still making little or no money in the present. So many companies from the technology sector.

Merciless reaction

Bad news from companies is severely punished in this environment: the shares of Spotify, Paypal and Netflix lost more than 20 percent in just one day after management presented disappointing quarterly results there. All three companies had seen massive sales growth during the pandemic. Now business is normalizing.

Netflix, for example, welcomed almost 16 million new customers in the first quarter of 2020, the first phase of the pandemic. For the start of the new year, the online video store now only expects 2.5 million new customers. In the logic of the stock markets, however, weaker growth usually also means lower prices.

A number of top shares in the stock market rally are still ambitiously valued despite falling prices: the Canadian software company Shopify, for example, which helps its customers set up their own online shop, recently lost around half of its market value – nevertheless, the share is still valued at more than 100 -Traded times corporate earnings.

For the broader tech market, the ratios are not quite as extreme: The average price-earnings ratio of the Nasdaq 100 rose from twelve to 20 in the years 2012 to 2020, according to the Bloomberg financial service database. With the pandemic, the number even shot up to 30 at its peak. So the prices have risen much faster than the forecasts for corporate profits. With the recent price correction, the P/E of the Nasdaq to around 25 shrunk, but is still around a quarter above the average of the previous decade.

Most of the heavyweights in the tech world have held up relatively well. The Google parent company Alphabet, Apple and Microsoft once again exceeded analyst expectations with their quarterly results. Amazon also surprised positively. The shares of the retail giant even shot up in double digits after the business figures were presented. Meanwhile, according to Bloomberg data, Amazon’s stock market value rose by $288 billion – that would be the largest daily gain ever recorded in terms of market capitalization and the counterpart to the meta crash.

The winners in the tech sector benefit above all from two unbroken trends: Alphabet continues to grow strongly thanks to the dominant position of its search engine Google through the placement of online advertising. Faster internet connections also mean that more and more users can receive advertising videos, which suits Alphabet’s YouTube video platform. According to data from the statistics portal Statista, the market for digital advertising will grow by an average of more than twelve percent by 2024.

Meanwhile, Amazon and Microsoft are benefiting from the demand for cloud services. Companies outsource their digital infrastructure to external servers to save costs and gain flexibility. Amazon, the clear leader in this space, increased revenue from its AWS cloud division by 40 percent last quarter. Microsoft, the closest rival in this space, rose at a similar rate.

The growth potential should still be great: The business with cloud services will grow by around 20 percent annually up to 2025, calculates the analysis company International Data Corporation.

The negative outlier among the tech giants is Meta Platforms. The group, which is known primarily for the Facebook and Instagram networks, has two problems: In the quarter, the number of daily active users fell for the first time. Apparently, the competition from TikTok is noticeable. The platform, which specializes in short videos, is particularly popular with younger users, who are therefore important for advertising customers. The meta-crisis is amplified by Apple: The iPhone manufacturer has given customers the option of better protecting their personal data in its operating system. This makes it difficult for data collectors like Facebook to place targeted advertising.

There is also trouble with the European Union: In the dispute over data protection regulations, Meta is now even threatening to close Facebook and Instagram, which would probably only be an extreme measure.

The big trend

Despite the turbulence, tech bulls still have good arguments on their side: The digitization of the world has only just begun. A number of growth stocks that seem expensive today will justify the optimism with strong profit increases, but not all.

Snap shows how intense the fight between bulls and bears is in the face of the turnaround in interest rates: shares in the short video network fell by almost 25 percent in the wake of the Facebook crash, but shot up by almost 60 the next day Percent up because Snap itself published good business figures.

After the historically weak January with a minus of nine percent for the Nasdaq 100, the markets should at least calm down. This is supported by the fact that most of the important tech companies have already presented their quarterly results. Of the ten largest index members by market capitalization, only Nvidia is still on the waiting list. The chip developer has announced its quarterly report for February 16th.

The slide in the technology sector should be a welcome opportunity for those looking for takeover targets. As always, potential buyers are the American tech giants, which are extremely well off thanks to their high profitability: Apple, Alphabet, Microsoft, Amazon and Meta have accumulated almost $650 billion in cash reserves, according to Bloomberg data. A significant part of this is likely to flow into share buybacks and dividends, but there are still large reserves for possible acquisitions.

Corporate hunters get started

Microsoft has already taken action and secured the games manufacturer Activision Blizzard in a spectacular deal for 69 billion dollars in order to prepare for the future in the Metaverse. Activision shares had previously lost around 40 percent in value. Where the big tech companies are not allowed to access due to antitrust restrictions, other buyers step in. Financial investors secured Citrix Systems, a specialist in enterprise software, in January at a valuation level of $16.5 billion.

The corporate hunters’ next target could be Peloton Interactive. The shares of the fitness company, which offers training bikes as well as online fitness courses, had risen massively during the pandemic, but then crashed. Amazon and the sporting goods group Nike are now being discussed as potential buyers for a takeover. Turbulent times always mean extraordinary opportunities.

INVESTOR INFO

Thanks to Google and YouTube, Alphabet is benefiting from the growing online advertising market. The conglomerate is expanding into new business areas: The cloud business is growing strongly, but is still relatively small. Services for autonomous driving also have long-term potential. After the steep price increase, the shares are to be split at a ratio of 20:1. That could pave the way for Alphabet to be included in the Dow Jones stock index. Setbacks remain buying opportunities.

Amazon is not only the world’s largest online retailer, but also a tech company. The most important course driver is the cloud division AWS, which brought in almost three quarters of the operating profit in 2021. In the online business, rising costs for wages and logistics are a burden. However, thanks to its size and market position, Amazon has strong leverage to improve profitability in online trading as well. A basic investment.

During the pandemic, many people subscribed to Netflix to pass the time. The momentum is now flattening out. For the first quarter, management calculates 2.5 million new customers, which would be 1.5 million fewer than at the start of the previous year. Netflix remains the market leader among streaming services, with 222 million customers most recently. The price-earnings ratio of the stock is moderate in historical comparison.

Ready for the turn

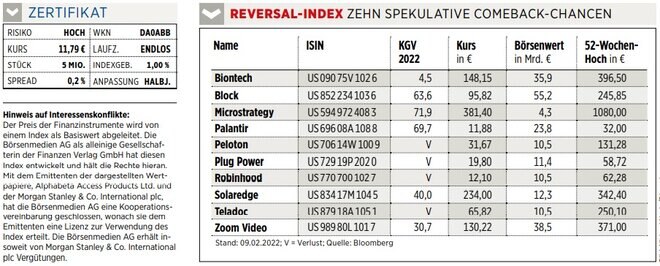

The new Börse Online Reversal Index reflects the price development of ten companies listed in the table on the right. These are stocks that have lost at least 60 percent of their high and have potential to catch up. With the certificate on the index, investors participate in the performance. Compared to an investment in a single stock, the risk is spread across several stocks. In order to ensure a balanced weighting of the members, the portfolio is adjusted twice a year.

____________________________________

Leverage must be between 2 and 20

No data

More news about Alphabet A (ex Google)

Image sources: Roberto Machado Noa/LightRocket via Getty Images, andersphoto / Shutterstock.com, Finanzen Verlag

ttn-28