by Bernhard Bomke, Euro on Sunday

AWhen the financial supervisory authority Bafin reported in December 2021 that it had discovered deficits in investment advice with test customers at banks, this only elicited a weary smile from some readers. At the same time, the news attracted attention for several reasons. On the one hand, because the supervisors had never sent out test customers before. They really weren’t allowed to. Only the Financial Market Integrity Act (FISG), which came into force in mid-2021, opened up this possibility. The Bafin intends to use this form of quality control more frequently in the future.

Secondly, the report by the supervisory authority was noticed because the deficits in investment advice are not really new, even if the Bafin declared that it had “taken a first direct and authentic look at the reality of the market”. For ten years now, uro am Sonntag has encountered a blatant lack of advice when we send test customers to bank branches.

Thirdly, the Bafin sent out 36 test customers. In our test this year (more on that later), there are almost twice as many, at exactly 70. And yes, they found a lot of light in their conversations in the bank branches, but also shadows.

Back to the check by the financial regulator. Twelve of the 36 mystery shoppers, as market researchers like to call test customers, found that there was a serious lack of advice. Specifically: In five cases, the declaration of suitability that is required as soon as investment advice is about securities was missing. No cost information was given for four calls. These are also required by law. In three tests, both documents were missing.

The deficiencies affected private banks as well as savings banks and Volksbanks. There were particularly many complaints from senior test customers. In every second interview, the required documents were missing. In the age groups below, only every fourth conversation was negative.

Bafin wants to “take a closer look”

Christian Bock, head of the consumer protection department at Bafin, is alarmed by the high shortage rate among older people. “Various individual risks come together in the older age groups. That makes older people a particularly vulnerable customer group,” he says. “An accumulation of anomalies was to be feared, and the data confirm that.” For him, this is a clear sign “that we will have to take a closer look at investment advice in the future”.

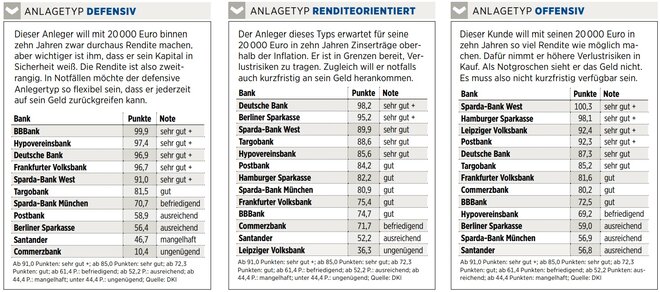

uro am Sonntag took a closer look and tested the banks’ quality of investment advice for the eleventh time. We again commissioned the German Customer Institute (DKI) to scrutinize the specific advice as well as the investment recommendations given by the bankers and customer service (see “This is how it was evaluated”). The institute sent out the 70 mystery shoppers who, in conversations with bank advisors, pretended to be savers with very different risk appetites – from conservative to profit-oriented to offensive. The idea behind it: We wanted to know whether the advisors gave individually correct recommendations or whether investors of all types were always offered the same products.

This time we audited 13 banks, including seven national and six regional institutions. The test included around 440 customer contacts, and the money houses were evaluated on 250 individual criteria.

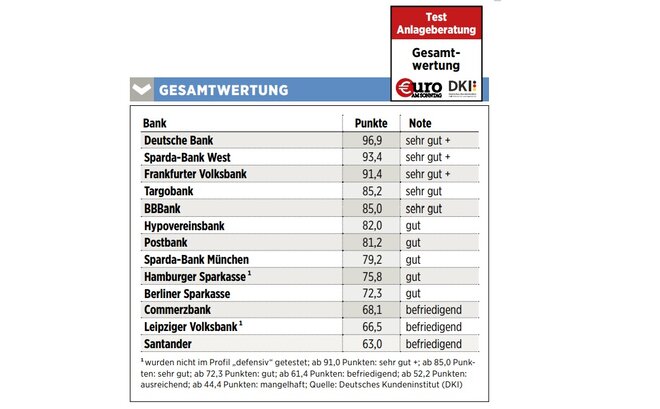

This time Deutsche Bank made it to first place. It was still second last year – and now, with Sparda-Bank West and Frankfurter Volksbank, relegated two regional institutes to places 2 and 3. The three banks achieved the top rating “very good +”. Reassuring from the point of view of investors: no bank was passed down the test with noticeably bad grades. For the bottom three in the table, Commerzbank, Leipziger Volksbank and Santander, it was still enough for a “satisfactory”. Last year’s winner, Volksbank Kln Bonn, did not take part in the test this time.

One of the things that convinced Deutsche Bank during the consultation was that the testers were asked in detail about their willingness to take risks in all of the discussions. This is by no means the case with every bank. In every sixth conversation, the mystery shoppers missed being asked in detail about their risk appetite. Positive: In all 70 conversations, the topic of willingness to take risks was at least somehow addressed.

These are also among the plus points of Deutsche Bank: In five out of six interviews, the testers were asked about their occupation, income, debts and previous experiences with investments. In five conversations, too, there were understandable or even very understandable risk information. In particular, the question of possible debts turned out to be by no means self-evident in the test. Only every second bank advisor came up with the idea of inquiring about it. In other words, 35 would have recommended shares, ETFs, bonds, pension funds or home savings contracts to investors without knowing whether their counterpart was more or less in the doldrums. Alarming.

Testers praise the consultants’ competence

The impression when determining the financial situation of the customers was also rather weak. This only took place completely in two out of three conversations. In every tenth conversation not a single word was said. And: As with the check by the Bafin, a certain degree of sloppiness in issuing declarations of suitability was also noticeable in our test. In 27 percent of the conversations in which the advisers recommended stocks, there was no such explanation.

In other aspects, however, we encountered a lot of positives. All customers were at least partially asked about their experiences with investments. In 67 of the 70 meetings, the customers received a specific investment recommendation. And: 96 percent of the mystery shoppers rated the professional competence of the advisors with grades 1 or 2. Three quarters of the testers would invest money in their advisor’s bank. Those are strong values.

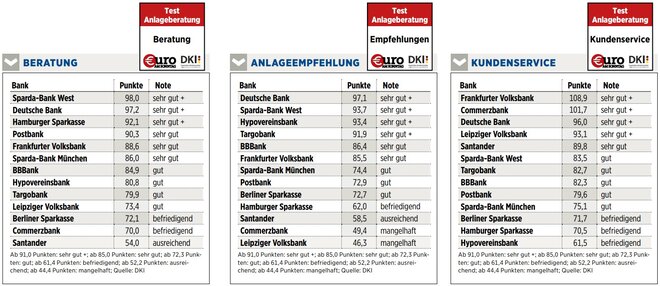

In the “Investment Recommendations” category, the field of banks tested was much broader. Deutsche Bank recommended the most suitable products to the sample customers. The front-end load and the management fee were below average for the investments recommended by the test winner. The running costs, on the other hand, slightly exceeded the average. At the other end of the table were Commerzbank and Leipziger Volksbank. In the average of all recommendations, both institutes came up with the grade “inadequate”. One of the reasons for this was that they each sent one tester home without a binding product recommendation. The irritating thing about it is that investors go to a consultant because of precisely such recommendations. When considering recommendations and advice together, both houses even only came up with an “inadequate” in one risk class. You have to do that first.

In general, the test once again revealed “that interested parties with different investment goals were often offered the same products,” criticizes DKI Managing Director Jrn Hsgen. Investors in all three defined risk classes were offered the “BBBank asset management” product line (investment funds and ETFs) at BBBank, and Commerzbank recommended the “Asset Management (Balance/Chance/Growth)” fund of funds to almost everyone who came, and the recommendations of Deutsche Bank, there was no way around the “Deutsche Bank Best Allocation” mixed fund. However, the recommended products were weighted differently depending on the customer’s risk appetite.

Entry fee increases and increases

With the costs of the recommended products, the arrow continues to point upwards. On average, the front-end load was 3.92 percent. For comparison: In the 2018 test, this value was still 2.94 percent. The Targobank recommendations had the lowest average front-end load of 3.23 percent. At Postbank it averaged 4.87 percent and was therefore the highest.

There were also major differences in the management fees for the recommended products. They were lowest at Deutsche Bank, Hypovereinsbank, Berliner Sparkasse and Hamburger Sparkasse with an average of zero percent. They were particularly high in the recommendations of Commerzbank (1.71 percent).

Another look at customer service. 84 percent of the 130 test calls were answered by the banks. The Sparda-Bank Mnchen was an outlier. Only every other call someone answered the phone. The testers found the friendliest and most helpful hotline employees at the Frankfurter Volksbank. The BBBank offered the most competence. Striking: the competence of the Sparda-Bank West hotline employees was only rated at an average of 3.7 on a scale of one to five.

Anyone who contacted the banks by e-mail received a response with a probability of 77 percent. Of these, however, only the help contained at least a partial answer to the questions asked. Bank Santander, bottom of the table in the entire test, shot the bird off the hook. She only responded to one in ten emails. After all, the answer was particularly friendly. This, in turn, had a positive impact on the rating.

The best investment recommendations for three investor types

What to do with my money On the basis of the three customer profiles: defensive, yield-oriented and offensive, the German customer institute for uro checked the quality of the investment advice on Sunday. In addition, we checked how precisely the investment recommendations matched the customers’ willingness to take risks. The Hamburger Sparkasse and the Leipziger Volksbank were not tested in the defensive investment type.

This is how it was scored

The German Customer Institute (DKI) tested the quality class of 13 banks for investment advice on behalf of uro on Sunday, primarily with the help of anonymous test customers. They appeared as investors with risk appetites ranging from defensive to yield-oriented to offensive. the Individual evaluations per customer profile, You will find below where the focus is on the quality of the advisory discussions and the investment recommendations.

The overall rating (see table below) included the ratings for all advisory meetings, investment recommendations and customer service. If a provider has more than 100 points in a category, this is due to bonus points.

Advice quality (weight: 40 percent): Here, among other things, it was checked how thoroughly the consultants explored the customer profile and, in particular, the risk appetite. In addition, the quality of the information provided and the reliability of making appointments were evaluated. Investment recommendations (40 percent): In this category, the testers checked whether the recommendations were suitable for the customer and how high the fees (issue surcharge, total costs) are.

Customer Service (20 percent): This was about the quality of information and service for inquiries via e-mail and telephone, the website and the social media presence.

_________________________________

Leverage must be between 2 and 20

No data

Image sources: kan_chana / Shutterstock.com, Szepy/iStock, Finanzen Verlag, Finanzen Verlag, Finanzen Verlag

ttn-28