shares in this article

Forex in this article

by Matthias Fischer, Euro on Sunday

More and more economists are warning of a looming recession. Reason: The rapidly rising inflation is forcing the central banks to react with higher interest rates. But if interest rates rise, the economy suffers: consumers save more because they collect more interest. And at the same time take out fewer loans because they want to avoid higher interest rates. Both reduce the propensity to consume.

Bank of America (BofA) also recently warned of an impending recession in the United States. And at the same time predicted that cryptocurrencies could emerge as winners from the scenario. According to Michael Hartnett, BofA’s chief investment strategist, cryptos could outperform stocks and bonds. As the Reuters news agency reports, Hartnett warned of sharp fluctuations in the stock market with words like “inflation shock intensifies, interest rate shock begins, recession shock is coming”. And advised bank customers to use cryptocurrencies in addition to cash and commodities.

advertising

That’s a surprising turn of events at the major US bank. “It wasn’t that long ago that BofA, along with countless other banking institutions, often railed against Bitcoin and the entire industry,” writes the CryptoPotato specialist portal. A year ago, the bank described Bitcoin as very volatile, which made it “impractical as a store of wealth or payment mechanism”. In the meantime, however, the major bank seems to be more optimistic and has even set up its own research department for cryptocurrencies.

Investor info

DOCUSIGN

Digital Signatures

Docusign stock knew only one way during lockdown times – up. The company was seen as one of the beneficiaries par excellence: Docusign focuses on digital contracts that also use blockchain technology. With the latest business numbers, however, management presented a less strong outlook than previously expected, and the stock slipped. Recently, however, she has been able to recover somewhat: Even after Corona, contracts should be signed digitally and no longer by hand. Docusign is a member of the Enterprise Ethereum Alliance.

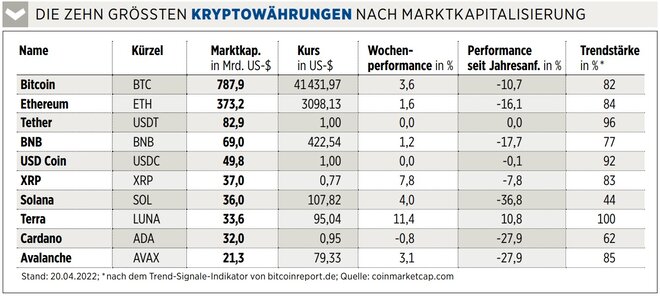

With the Krypto-Maxx-Certificate of the €uro-am-Sonntag sister publication €uro, investors can rely on the entire value chain for cryptocurrencies and blockchain in a broadly diversified manner. The portfolio includes numerous cryptocurrencies such as the top dog Bitcoin, its pursuer Ethereum and climbers such as Solana or Cardano. In addition, the paper also focuses on companies that are part of the crypto value chain, such as miners, financial service providers or technology companies. The proportion of currencies and shares is about the same, plus a smaller cash position.

Leverage must be between 2 and 20

No data

Image sources: Stanislav Duben / Shutterstock.com, Wit Olszewski / Shutterstock.com, Finanzen Verlag