Dhe road to black is paved with gold. Anyone who owns the legendary Black Card from American Express has not only finally made it, but must have previously used the provider’s Gold Card and Platinum Card. Only then will there be a chance for long-standing, super-solvent customers to receive the black Centurion Card – admission to the club of the super-rich is by invitation only. Amex is silent on the amount of assets or income required. At least parts of what is available for an annual fee of 5,000 euros is known: limousine service, access to VIP lounges at airports and concierge service, i.e. a personal assistant who can book trips around the clock, do shopping or book tickets for a can organize a sold-out concert.

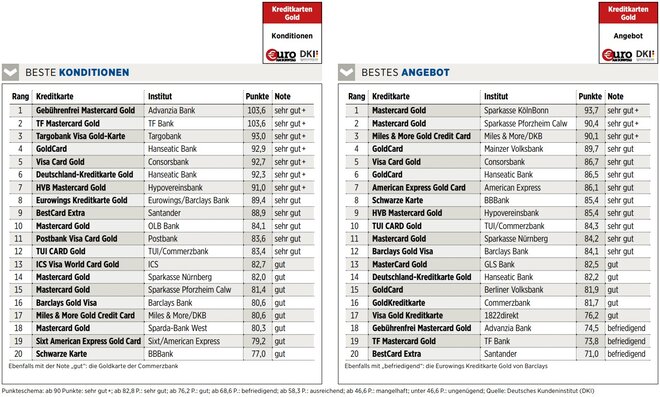

You don’t get all this with the conventional gold cards. Anyone can afford it, at least after the obligatory credit check. In the previous issue, uro on Sunday published the test of standard credit cards, this time it’s the gold ones (including a black card from BBBank, which however has nothing in common with the black Centurion). The test was again carried out by the German Customer Institute (DKI) in Dsseldorf, which examined 28 credit cards and set up 250 individual criteria (see “How the test was done”).

Anyone who buys a gold card usually does so for one reason: because it comes with additional insurance benefits. Mind you, that’s a lot of products that experts classify as “you don’t have to have them”. But if you want them, they’re included with the tickets, although by no means all of them are included in every offer.

With a few exceptions, this costs extra compared to standard credit cards. There is no annual fee for only three of the cards tested – but as the test shows, even that sometimes has its price. Four more gold cards are free in the first year, from the second year they cost between 35 euros (Hanseatic Bank, ICS and Santander) and 144 euros (American Express). Sometimes the fee is reimbursed from a certain annual turnover. If it’s 3,000 euros for the Germany credit card and the Hanseatic Bank, it has to be 12,000 for the Hypovereinsbank and even 20,000 euros for the Sparda Bank West.

Without opening an account at the relevant bank, 15 of the 28 gold cards tested are available. The account is only necessary with Santander, but it is free of charge without any conditions. With 1822direkt, Commerzbank and Consorsbank there are no costs with a minimum monthly payment of 700 euros. The Sparkasse Nrnberg held out the hand the furthest with 178.80 euros.

What the insurance companies are good for

Back to insurance and the question of what the policies included with the gold cards can actually do. 24 of the 28 cards include travel health insurance – which makes sense. The cards from BBBank, Berliner Volksbank and Mainzer Volksbank offer the best conditions for this. Their protection also applies if the trip was not paid for with the card, applies worldwide and for the first 45 days of every stay abroad. The sum insured and the age of the travelers are unlimited, family members are also insured if the owner of the card is not traveling with them at all.

Travel cancellation insurance is included with 22 tickets. The Mastercard Gold of Sparkasse Köln Bonn and Sparkasse Pforzheim Calw lead the field. Here, too, the benefits apply regardless of the use of the card. Age, number of insured persons and travel duration are unlimited. The sum insured is 10,000 euros.

With 20 cards there is a trip interruption insurance. The holders get the best conditions from GLS Bank, the worst are found with Advanzia Bank’s Mastercard Gold and TF Mastercard Gold. Germany’s Gold credit card and the GoldCard from the Hanseatic Bank offer top conditions for luggage insurance, which is included with eight providers. The insured event occurs even if the luggage is four hours late.

Eleven cards offer a motor vehicle protection letter. BBBank and Berliner Volksbank have the best conditions here: The protection applies, for example, throughout Europe and in the non-European countries bordering the Mediterranean Sea.

The DKI testers found the Visa Card Gold from Consorsbank to be the best insurance package overall. It includes travel health insurance, travel cancellation, travel interruption and luggage insurance as well as an extensive travel assistance package, goods delivery protection insurance and mobile phone protection. However, it costs an annual fee of 60 euros.

The best offers: direct banks

Consorsbank’s golden plastic money was rated “very good” overall in the test and took second place among the direct banks. The Hanseatic Bank gold card was slightly better overall and was able to collect the second most points in the entire test. Together with the Consorsbank, the Hanseatic Bank also offers the best value for money in the test.

regional banks

The Mastercard Gold from Sparkasse Pforzheim Calw scored the most points with 91 out of a possible 100 points. At the same time, it represents the best overall package among the regional banks. In terms of conditions, however, the Pforzheimer Goldkarte only made it to 15th place with a “good”. Because: A prerequisite for the card is the opening of an account at the bank. The annual fees of 42 euros are reduced to 30 euros with a monthly minimum payment of 1,500 euros. The fee for the card itself is 72 euros from the second year. Although this is above the average of all cards tested, cash withdrawals outside of Germany are free of charge. A fee of only 1.25 percent of the amount is charged for payment transactions in foreign currency. Included is a foreign travel health insurance, a travel cancellation and a travel interruption insurance as well as a motor vehicle protection letter. The GoldCard from the Mainzer Volksbank came in second among the regional ones, scoring particularly well in terms of customer service and the range of offers.

Nationwide branch banks

Among the nationwide branch banks, Commerzbank was the only one to achieve the grade “very good”. She was among the best especially when it came to customer service. The second largest German bank was followed by Hypovereinsbank, whose price-performance ratio convinced the DKI testers. Among the winners, only the Hanseatic Bank has a partial payment function, ie the option of not completely repaying the credit granted via the card. In general, only eleven of the providers examined offer this service. Installment breaks of between 24 (Targobank) and 59 days (Barclays Bank and Eurowings/Barclays Bank) are possible for six of them. The GoldCard from the Hanseatic Bank scored best here with “very good +”.

This is how it was tested:

A total of 28 credit cards were tested by the German Customer Institute on a scientific basis in three areas according to 250 individual criteria. In the “Conditions” category, these include the requirements for obtaining a card, the annual fee in the first year and from the second year, the fees for cash withdrawals and payment transactions, interest on the credit balance or the liability limit in the event of card misuse. Points such as maximum availability, billing types, receipt of partner cards, contactless payment and included insurance or bonus services went into the “Offer” category. “Customer service” was about, among other things, speed and competence in answering inquiries by e-mail or telephone. The overall rating includes conditions and offers with 35 percent each and customer service with 30 percent.

For reasons of space, we have only presented the best offers here.

Image sources: Hamik / Shutterstock.com, Olleg / Shutterstock.com, Finanzen Verlag, Finanzen Verlag, Finanzen Verlag, Finanzen Verlag

ttn-28