by Nikolas Kessler, Euro on Sunday

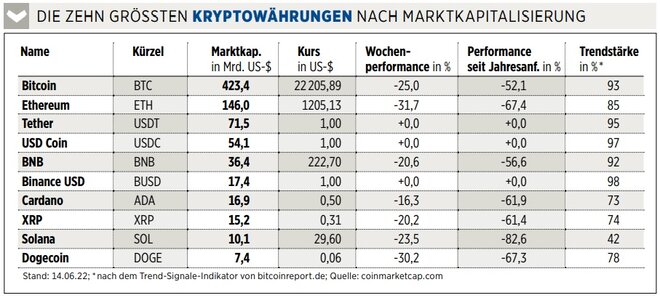

Temporary payout problems at the world’s largest crypto exchange Binance and frozen accounts at the DeFi project Celsius recently triggered another crash in a market weakened by rising inflation and fears of recession. Bitcoin lost up to a quarter of its value in just 48 hours and in some cases marked its lowest level since mid-December 2020.

This in turn is now becoming a problem for companies related to the crypto sector – especially MicroStrategy. The software company started investing every free cent in Bitcoin around two years ago and even went into debt for it. Around 129,000 Units of the digital currency are now on the balance sheet – more than any other listed company. At current rates of around $22,000, the Bitcoin treasure is still worth around $2.84 billion. However, MicroStrategy paid an average of around $30,700 per bitcoin, for a total of almost four billion dollars. MicroStrategy CEO Michael Saylor tries to calm things down via Twitter by explaining that the well-known very high volatility has been taken into account and that the strategy can continue even in difficult times. The stock fell 30 percent on Monday a week ago.

advertising

Trade Binance Coin and other cryptos with leverage (long and short)

In addition, in the next quarterly report, there will be a hefty write-down on the Bitcoin losses, even if not a single one is actually sold by then. A similar fate awaits Tesla, Block and all other companies that own cryptos – albeit to a much lesser extent.

INVESTOR INFO

Crypto exchange operator Coinbase is gearing up for “crypto winter” and a looming recession with downsizing. As was recently announced, the US company is cutting 18 percent of its approximately 5,000 full-time jobs. Given the bleak outlook for the crypto and overall market, CEO Brian Armstrong said in an email to employees that he needed to lower cash burn and increase efficiency. He also acknowledged that Coinbase grew “too fast” during the last bull market. On the one hand, this is consistent, but it means further headwind for the already badly battered Coinbase share. watchlist!

21Shares Bitcoin ETP

According to data from the analysis company Glassnode, the recent crash on the crypto market means that even very long-term oriented investors are capitulating and (have to) sell their holdings – sometimes even at a loss. The experts speak of the “darkest phase” of the Brenmarkt. According to market cycle theory, capitulation is the last major sell-off followed by stabilization. Investors who, despite the recent turbulence, are convinced of the long-term prospects of the leading digital currency can use this to get started or to make additional purchases – either by direct purchase or with the Bitcoin ETP of 21 shares.

________________________________

Leverage must be between 2 and 20

No data

Image sources: Travis Wolfe / Shutterstock.com, Wit Olszewski / Shutterstock.com, Finanzen Verlag

ttn-28