funds in this article

shares in this article

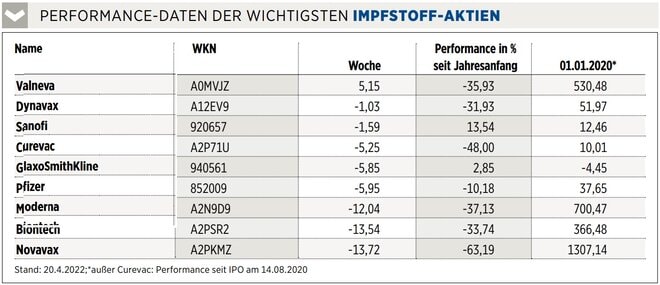

BioNTech, Moderna and Novavax had to lose feathers in the past few days. And this despite the fact that Moderna wants to be the first manufacturer to apply for approval for children under five in the coming days and has also presented quite positive data on an adapted vaccine. The bivalent vaccine contains mRNA material from both the original virus and the beta variant, which at times was circulating mainly in South Africa. As a booster, the product candidate led to a robust immune response against beta, delta and omicron viruses in study participants. However, the data are difficult to compare with those of approved vaccines. However, Moderna does not necessarily want to pursue the construct further, but relies on a vaccine that contains mRNA of the wild-type virus and the omicron variant. Results should be available by the end of June. BioNTech studies on customized boosters should also provide data soon.

However, investors have doubts about the willingness of the population to be vaccinated again – after all, the vaccination rate is mediocre after the third shot. In view of the mild course at Omikron and the increasing easing, vaccine producers are therefore feeling a strong headwind on the stock exchange. By autumn at the latest, however, things can look very different again.

Notice of Conflicts of Interest:

The majority owner of the sole shareholder of Finanzen Verlag GmbH, Mr. Bernd Förtsch, has taken direct and indirect positions on the following financial instruments mentioned in the publication or related derivatives that can benefit from any price development resulting from the publication: BioNTech, CureVac, GlaxoSmithKline , Novavax, Pfizer, Valneva.

INVESTOR INFO

The stock rose thanks to the conditional approval of the COVID vaccine in the UK. Although the UK has canceled the original supply agreement with Valneva, the company is currently negotiating with Scotland to purchase 25,000 cans. The sales market is more lucrative in the EU, which intends to purchase 24 million cans in the current year, with the option of purchasing a further 36 million at a later date. Here, too, the approval authority should soon make a decision. Valneva’s most attractive asset remains the Lyme disease vaccine candidate, which is expected to enter the final study phase later this year.

Sentiment remains bleak in the biotech sector, with investors remaining skeptical about growth stocks due to rate hikes and the generally unsettled environment. It is all the more important that the performance of Bellevue Biotech has been rising significantly since mid-March. Moderna shares are among the top positions with a good three percent share. The fund managers Christian Lach, Samuel Stursberg and Lukas Leu, all with a scientific background, focus primarily on medium-sized and large companies that already have a more mature product portfolio.

Image sources: Pavlo Gonchar/SOPA Images/LightRocket via Getty Images, Marco Lazzarini / Shutterstock.com, Finanzen Verlag

ttn-28