The word “premium” bodes well. Here exclusive instead of standard beckons. However, since we all have a certain amount of life experience, we know that premium does not come for free, but only at an additional cost. This is the case with premium cars or with premium hotels. Usually the same for premium current accounts. But not necessarily: Under certain circumstances, the “better” account is even available for free.

What distinguishes a premium current account from a standard product are the additional services: It often includes credit cards, which in turn include various insurance policies and other bonus offers, for example from car rental companies. Anyone who affords such a product actually wants to save money.

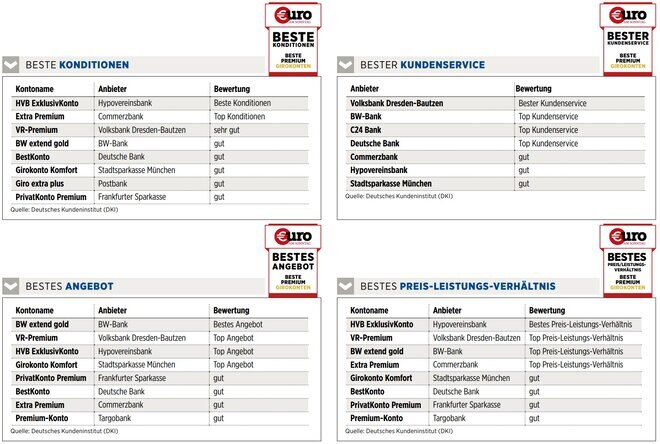

The only question is which offers are the best. The German Customer Institute (DKI) investigated this on behalf of €uro am Sonntag. The offers from all over the country were scrutinized. However, the prerequisite was that the banks also offer a cheap standard account.

With a premium account, the customer expects added value. However, it is not easy to find out, since the account models differ greatly in some cases. Therefore, the DKI has created a reference model account with certain common conditions to ensure the comparability of the offers. But not only the conditions were examined, but also the offer and the customer service (see: How the rating was done).

So much for theory, now for practice. In the conditions test category, Hypovereinsbank’s HVB Exclusive Account and Commerzbank’s Extra Premium came top, followed by BW Bank’s BW extend gold and Volksbank Dresden-Bautzen’s VR-Premium. The cheapest of the premium offers can be opened at C24 for EUR 9.90 per month. However, most banks charge additional fees in addition to account fees, for example for credit cards, withdrawals or deposits. At Hypovereinsbank it’s the other way around: the monthly account management fee of EUR 14.90 can be reduced by 25, 50 or even 100 percent if the customer takes part in the free HVB valyou bonus program. The 25 percent is available if at least two of the bank’s products are used – which is already the case with the credit cards that the premium account contains. If you take out online, you even save the fee completely in the first year

A few more details from the conditions that are worth paying attention to: The interest rate for an overdraft facility varies between 4.88 percent at Volksbank Dresden-Bautzen and 10.90 percent at Deutsche Bank. Girocards are free for all offers, as are withdrawals at the institute’s own counters.

Paying by credit card in the euro zone is free of charge in all cases. In countries with a foreign currency, this is only the case with C24, otherwise there are fees of between 1.00 and 1.75 percent of the amount. Withdrawals in foreign currencies are only free from HVB and Stadtsparkasse München.

In principle, there are no free credit cards included with this or the Targobank, but with the Hypovereinsbank there are up to five. Commerzbank offers four, the other banks at least one. Which brings us to the offer test category. The Frankfurter Sparkasse credit card only costs nothing in the first year. But there is a gold or premium card – just like at BW Bank, Deutsche Bank, Hypovereinbank and Volksbank Dresden-Bautzen. You can get them at a reduced price from the Postbank, but only standard cards are available from the other providers.

The additional services

The most comprehensive additional services are offered by BW-Bank, Hypovereinsbank and Targobank. At BW, the account includes travel health and travel liability insurance, emergency cash service abroad and a cashback program for shopping, trips and tickets. The HVB also includes extensive insurance and cashback programs, and the Targobank also offers fully comprehensive rental car insurance and an insurance package against ATM robbery. All in all, these three banks and Stadtsparkasse München performed best in this test category.

Things are different when it comes to customer service: Volksbank Dresden-Bautzen, BW-Bank, C24 and Deutsche Bank are leaders here. However, apart from two “sufficient”, there were no serious differences between the institutes. All websites were found by the test customers commissioned by the DKI to be clear, self-explanatory and clearly structured. With the exception of Stadtsparkasse München, all account models are compared there in tabular form. However, the information on the conditions was only perceived as comprehensive by two providers, the information on the services and advantages of the premium accounts only by three.

When it came to direct contact via the hotline, Commerzbank performed best, with employees rated as the friendliest, most helpful and also the most competent. The quickest replies via email came from C24.

The serial winner

The bottom line is that the winner of previous years, the HVB exclusive account from Hypovereinsbank, offers the greatest added value compared to a standard current account and has now been the test winner for the fifth time. It offers the best conditions, coming in third in terms of offering and sixth in terms of customer service. The monthly account management fee of EUR 14.90 can even be reduced to zero thanks to the in-house bonus program if the customer uses at least five products from the bank (including a salary account) and has assets of 75,000 euros there.

The interest rate for an overdraft facility is among the highest, but that for tolerated overdrafts is about average, according to the DKI testers. The biggest trump card of the account is probably the HVB Mastercard Gold, which is mandatory in addition to a Visa debit card: With it, cash can be withdrawn free of charge from any ATM worldwide. Payment transactions are only subject to a fee outside the euro zone at 1.75 percent of the amount called. In addition, the credit card includes various additional services: In addition to insurance such as motion sickness, trip interruption or trip cancellation, emergency cash abroad and various reimbursements for ticket and travel bookings.

In the case of the Postbank Giro extra plus account, which was the weakest in relative terms, the testers criticized the high fees – EUR 10.90 per month plus EUR 79 per year for the credit card, plus costs for payment transactions abroad and withdrawals in foreign currencies. The interest rate for the overdraft facility, on the other hand, was quite low. Comparatively few additional services are available for the credit card. And customer service at Postbank was not ideal either: only four out of ten calls were answered, and the waiting time on the hotline was by far the longest. But as I said at the beginning: None of the premium current accounts did really badly.

This is how it was scored

The test: The German customer institute DKI examined premium current accounts for €uro am Sonntag for the fifth time. The offers from ten regional and national German banks were examined between February and April 2022. 250 individual criteria were taken into account. In addition, around 280 contacts were made through test customers who not only asked “completely normal” customer questions, but also checked the conditions stated in the advertising and got an idea of the service provided by the bank and its employees. The test was divided into three criteria: conditions, offer and customer service. In addition, the price-performance ratio was examined, but not included in the test result.

The conditions: They make up 40 percent of the test result. Among other things, it was about account management fees, interest rates for overdraft facilities and tolerated overdrafts, minimum terms, annual fees for Girocard and credit cards and fees for cash withdrawals, payment transactions, transfers and standing orders.

The offer: It also accounted for 40 percent of the test result. Relevant here were, among other things, the number of ATMs where bank customers can get cash free of charge, security procedures (e.g. ChipTAN, mTAN, photoTAN), giro and credit card functions, additional services (e.g. insurance or discounts) and the possibility of online -Legitimation.

The customer service: It represents 20 percent of the test result. The banks’ hotline was tested here in terms of waiting time, competence, friendliness and helpfulness. The same applied to contacts via e-mail. In addition, the information and services offered on the websites were assessed.

Image sources: Olleg / Shutterstock.com, Lisa S. / Shutterstock.com, Finanzen Verlag, Finanzen Verlag

ttn-28