funds in this article

shares in this article

Forex in this article

by Nikolas Kessler, Euro on Sunday

With the jump above the $48,000 mark at the beginning of the week, Bitcoin marked a new high for the year and at the same time completely compensated for the losses since the beginning of the year. The leading digital currency is now back in the black for the first time since the beginning of January. The mood among market participants has also brightened noticeably as a result: the “Fear & Greed Index” for the crypto market rose to 60 points on Monday, its highest level since mid-November.

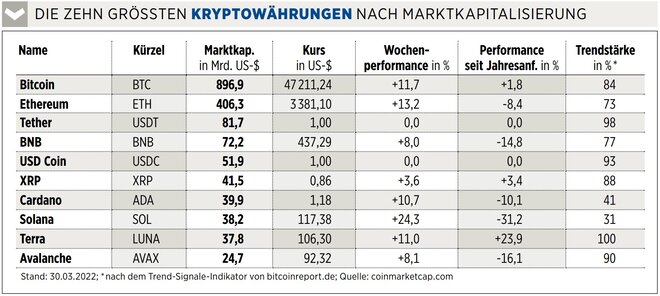

The increase is accompanied by strong inflows of funds into financial products that allow participation in the price development of cryptocurrencies – and are therefore also very popular with institutional investors. According to data from the analysis company CoinShares, 193 million dollars flowed into corresponding products last week. Bitcoin-related funds and ETPs accounted for just over half of that at $98 million. Products on Solana were also in high demand. With an increase of 24.3 percent, the coin was by far the top performer among the ten largest cryptocurrencies by market capitalization on a weekly basis. Compared to the beginning of the year, however, Solana still shows the largest discount.

advertising

Cryptocurrencies have corrected sharply over the past few weeks. Speculative investors now trade CFDs on the world’s most popular cryptocurrencies with leverage and 24/7 availability with Plus500.

act now77% of retail investor accounts lose money when trading CFDs with this provider. You should carefully consider whether you can afford to take the high risk of losing your money

One of the possible explanations for the price increase is the increasing willingness of investors to take risks, which can currently also be observed on the stock markets. Those who are willing to sell are likely to have been shaken out of the market by the pronounced correction of the past few months and any risks relating to the US interest rate turnaround and regulation have been priced in appropriately.

INVESTOR INFO

Michael Saylor, CEO of the software group Microstrategy, has done it again: After he exchanged almost all of his company’s cash holdings for Bitcoin and then raised additional capital for purchases on the bond market, Microstrategy has now taken out a loan of around 205 million dollars through a subsidiary and secured with a part of the Bitcoin hoard of around 125,000 units. The loan should in turn be used, at least in part, to buy more bitcoins. The result: the fate of Microstrategy stands or falls with Bitcoin – investors must be aware of this.

Investors who have become curious about the crypto market as a result of the dynamic upward movement can invest in five top coins with an ETP on the Crypto Basket Index from 21Shares with just one product. In addition to Bitcoin, Ethereum, Cardano and Polkadot, this also includes weekly winner Solana – weighted according to their respective market capitalization. The product can easily be purchased through a bank or broker as a traditional security. In addition to 2.5 percent fees per year and the high volatility of the underlying, buyers of the ETP also have to accept an issuer risk.

___________________________________

Image sources: Wit Olszewski / Shutterstock.com, Finanzen Verlag

ttn-28