shares in this article

by Julia Groß, Euro am Sonntag

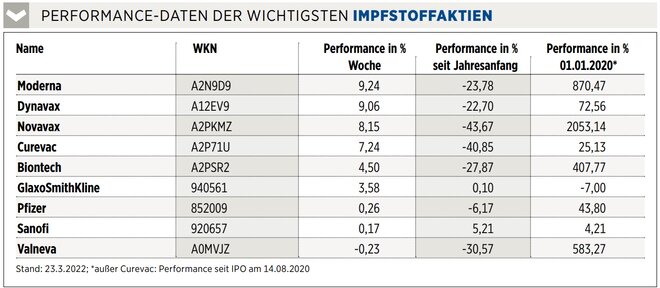

Dhe fourth dose seems to be slowly becoming a reality in more and more developed countries, at least for part of the population. Both BioNTech/Pfizer and Moderna have applied for approval in the US, BioNTech/Pfizer for over 65s, Moderna even for all adults.

Together with further orders (for example from Switzerland, which ordered seven million doses from Moderna for 2023) and the increasing number of cases in Europe, this has given the shares of the two market leaders a boost. Moderna also scored with further news about the product pipeline (see Investor Info). BioNTech may be able to follow suit with good news in the coming week: The Mainz-based company will present its balance sheet on Wednesday next week. In addition, the first results from the studies on an adapted omicron vaccine are expected soon.

The upward trend at Novavax seems a bit bumpier. But the price development at the US company is also pointing upwards. Novavax, with its partner Serum Institute of India, has received emergency use authorization to vaccinate adolescents between the ages of 12 and 18 in India. Adjuvant manufacturer Dynavax, like Curevac, benefited from the generally more positive environment for manufacturers of Covid vaccines.

A notice: Conflicts of interest: The majority owner of the sole shareholder of Finanzen Verlag GmbH, Mr. Bernd Förtsch, has taken direct and indirect positions on the following financial instruments mentioned in the publication or related derivatives that may benefit from any price development resulting from the publication: BioNTech, Curevac, GlaxoSmithKline, Novavax, Pfizer, Valneva.

INVESTOR INFO

As early as next week, the company wants to apply for approval of the Covid vaccination for children under the age of six – ahead of BioNTech and Pfizer. In addition, the Americans announced the start of clinical studies of a combination vaccination against SARS-CoV-2, flu and RSV and a vaccination against the four common human corona viruses except SARS-CoV-2. The latter sounds like the preparation of a so-called pan-coronavirus vaccine that protects against numerous pathogens with pandemic potential. More details may be available on Thursday at Moderna’s Vaccine Day, which took place after this issue went to press.

The Swiss investment company got involved with Moderna early on, and with a share of around ten percent, the shares are currently the largest position in the portfolio of just over 30 up-and-coming biotech stocks. The management team, which has often demonstrated its good instincts in the past, sees potential at Moderna well beyond the Covid vaccine. Additional heavyweights in the portfolio include Ionis Pharmaceuticals, another RNA company, as well as the world leader in cystic fibrosis drugs, Vertex, and Argenx, a specialist in antibody therapies for autoimmune diseases.

____________________________________

Leverage must be between 2 and 20

No data

More news about arGEN-X NV

Image sources: Marco Lazzarini / Shutterstock.com, Ascannio / Shutterstock.com, Finanzen Verlag

ttn-28