The main challenge for the coming years is that the achievements in stabilization have continuity in a sustained process of economic development. That’s why, The main proposal that President Milei raised, in his speech for his first year in office, is to return tax autonomy to the provinces.. This is an essential transformation in view of the objective of promoting better functioning of the public sector, a necessary condition for increasing investment, production and employment.

Currently, the law of co-participation passed at the end of the Alfonsín government still governs with a clear intention of transitory nature. With co-participation, The Nation is responsible for collecting national taxes and assigning them to a common pool (co-participation mass) to distribute them between the Nation and each province according to fixed parameters (co-participation coefficients).. What the president proposes is to return to the scheme originally provided for in the Constitution, which consists of each jurisdiction collecting taxes from its inhabitants to finance its public spending.

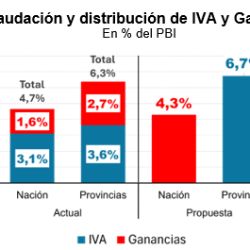

The question is how to put into practice the idea of tending towards self-financing of the provinces without generating traumatic situations.. To answer it, it is useful to analyze how much is collected and how VAT and Profits are distributed, which are the two main national taxes. According to the Ministry of Economy, with data referring to the 2024, It is observed that:

– He VAT collects 6.7% of GDP and 3.1% is distributed to the Nation and 3.6% to the provinces.

– Profits collect 4.3% of GDP where 1.6% goes to the Nation and 2.7% to the provinces.

– Between VAT and Profits are collected approximately 11% of GDP of which the Nation appropriates 4.7% of the GDP and the provinces 6.3% of the GDP.

These data show that could be move towards the return of tax autonomy to the provinces by establishing that all Profits are appropriated by the Nation and all VAT is appropriated by the provinces. Thus, the Nation would receive the 4.3% of the GDP that Profancias collects, which is similar to the 4.7% that it receives today through co-participation, and the provinces would receive the 6.7% of the GDP that is collected with VAT, which is similar to the 6.3% that they currently receive from co-participation.

In the distribution of VAT between each province, the rule should be similar to the one that the provinces themselves chose to allocate the tax to gross receipts. That is, each province keeps the VAT generated in its territory and, when it is an interprovincial sale, half of the VAT is assigned to the province of origin and the other half to the province of destination. Under this scheme it is easier move towards the unification of VAT with gross income and municipal industry and commerce rates. Obviously, the “super VAT” rate has to be higher than the current 21%, but this is simply explaining the current tax pressure that arises from the sum of VAT plus gross income plus municipal taxes. The administration of the “super VAT” should continue to be the responsibility of the ARCA, but on behalf of and by order of the provinces, and applying the new distribution rule on a daily basis.

Under this scheme the need for a co-participation regime disappears since each jurisdiction will be financed with the taxes generated by the economic activity of its territory. For the most lagging provinces in the north – which currently do not have the capacity for self-financing – a traumatic situation can be avoided by guaranteeing in the transition the continuity of the resources that they have today through a Convergence Fund. The main difference with co-participation is that the Convergence Fund involves a much smaller mass of resources – since it is focused only on the lagging provinces – and the transfers are conditional on not being used for clientelism – as is the case with co-participation. but to shorten development gaps.

Concentrating the tax collection in a bag and then distributing it through co-participation is a deviation from the original design of the Constitution that led to the deconfiguration of the federal regime. Therefore, it is a priority to reestablish the principle – supported by the theory of public finances – of fiscal correspondence. That is, the jurisdiction that decides the expenditure charges the tax to finance it and is accountable.

You may also be interested

by Jorge Colina